| What is Downside Risk? |

|

Most people aren't tossing and turning at night over why their retirement account is only raking in annual returns of just 5%. According to a number of studies, what fuels an investor's sleepless nights (and their investment decisions) is the fear of negative returns. In fact a British study found that the experience of losing money—or even the anticipation of a financial loss—is processed by the brain in a similar fashion to physical pain.

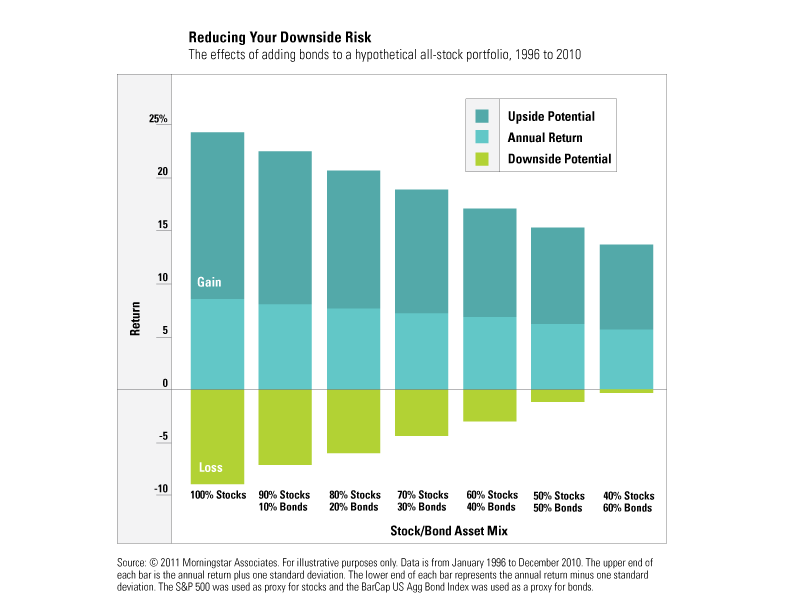

That's why it's so important to consider downside risk when constructing the investment strategy for your retirement account. Basically, downside risk is the degree of losses you could potentially sustain if market conditions deteriorate. What drives downside risk is the aggressiveness of your portfolio, which is generally determined by how much of your account is allocated to stocks (all investments carry risk, though stocks tend to be riskier than bonds and cash). The greater the allocation to stocks, the higher the risk, and thus the more exposed you are to losses (as well as the wider the variance of your returns). The flip side, however, is that the more aggressive your portfolio, the greater your potential for gains. There are three things you can do to help minimize downside risk: |

| 1. Diversify Your Portfolio |

| The first is to ensure that you have the right allocation among stocks, bonds, and cash. The more stocks in your portfolio, the riskier it is. By incrementally adding bonds and cash, you can help reduce that risk. The tradeoff, as you can see in the chart below, is that that by reducing your downside risk you also diminish your potential for gains. Your goal is to find a comfortable balance. You should consider a number of factors when determining that balance—your age, time horizon to retirement, risk tolerance level, and your account balance, to name just a few. |

|

> Home

> Glossary > Support |

| Questions & Answers | |||

| How can you minimize your downside risk exposure? | |||